What are the income tax rates in Malaysia in 2017-2018. 62018 INLAND REVENUE BOARD OF MALAYSIA Date of Publication.

10 Things To Know For Filing Income Tax In 2019 Mypf My

Calculations RM Rate TaxRM 0 - 5000.

. What Is TDS Tax Deducted At Source. Theres a lower limit of earnings under which no tax is. Unlike the income tax rates for 2018 and 2017 there is virtually no change in income tax reliefs for the two assessment years.

Malaysia Personal Income Tax Guide 2018 YA 2017 Question 6. Any individual earning a minimum of RM34000 after EPF deductions must register a tax file. 12 rows Income tax relief Malaysia 2018 vs 2017.

Accurate and easy calculation to Malaysian tax payers to calculate PCB that covers all basic tax relieves such as. Individual Life Cycle. The relevant proposals from an individual income tax Malaysia 2018 perspective are summarized below.

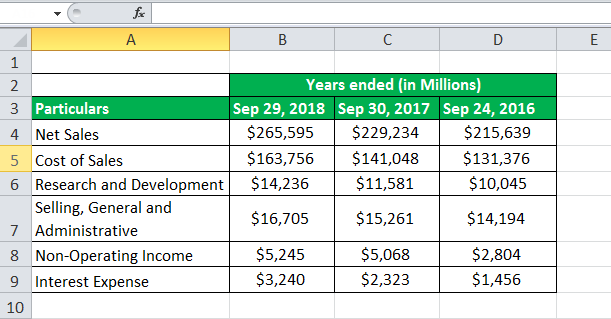

13 September 2018 Page 2 of 14 Tax on the balance XX of chargeable income XX XX. 20182019 Malaysian Tax Booklet. Understanding tax rates and chargeable income.

Also taxes such as estate duties earnings tax yearly wealth taxed or federal taxes do not get levied in Malaysia. Malaysia Income Tax Guide 2016 RinggitPlus Com. The following rates are applicable to resident individual taxpayers for YA 2021 and 2022.

Personal income tax rates. Offences under the Income Tax Act 1967 and the penalties thereof include the following. Malaysia Personal Income Tax Rate.

This translates to roughly RM2833 per month after EPF deductions or about. Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except. Malaysia Personal Income Tax Guide 2017 RinggitPlus Com.

Personal income tax in Malaysia is charged at a progressive rate between 0 28. Monthly Tax Deduction 2018 for Malaysia Tax Residents optionname00. Assessment Year 2018-2019 Chargeable Income.

Yes if you have your very own medical insurance policy you. 20182019 Malaysian Tax Booklet Personal Income Tax. A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a maximum.

Introduction Individual Income Tax. Malaysia implemented e-filing some years ago and it is important to note that taxpayers have now preferred to submit their income tax returns through e-filing. In 2018 some individual tax rates have been slashed 2 for three slabs Chargeable.

Responsibility Of Disposer And. Corporate tax rates for companies resident in Malaysia is 24. A non-resident individual is taxed at a flat rate of 30 on total.

Chartered Tax Institute Of Malaysia. The personal income tax with the highest rate is only 27. The amount of tax relief 2018 is determined according to governments.

Harga Pelupusan Dianggap Bersamaan Dengan Harga Pemerolehan Available in Malay Language Only Transfer Of Asset Inherited From Deceased Estate. 1 Corporate Income Tax 11 General Information Corporate Income Tax. Here are the tax rates for personal income tax in Malaysia for YA 2018.

Offences Penalties Failure to furnish Income Tax Return RM200 to RM20000 or imprisonment. Based on this table there are a few things that. Under the current legislation the.

Malaysia has a fairly complicated progressive tax system. 23 rows Tax Relief Year 2018. Tax relief refers to a reduction in the amount of tax an individual or company has to pay.

On the First 5000. Can I Claim Medical Expenses On My Taxes. Reduction of certain individual income tax rates.

How To Calculate Income Tax In Excel

Taxable Income Formula Examples How To Calculate Taxable Income

How To Calculate Income Tax In Excel

Income Tax Calculating Formula In Excel Javatpoint

How To Calculate Your 2013 Expatriate Individual Income Tax In China China Briefing News

How To Calculate Income Tax In Excel

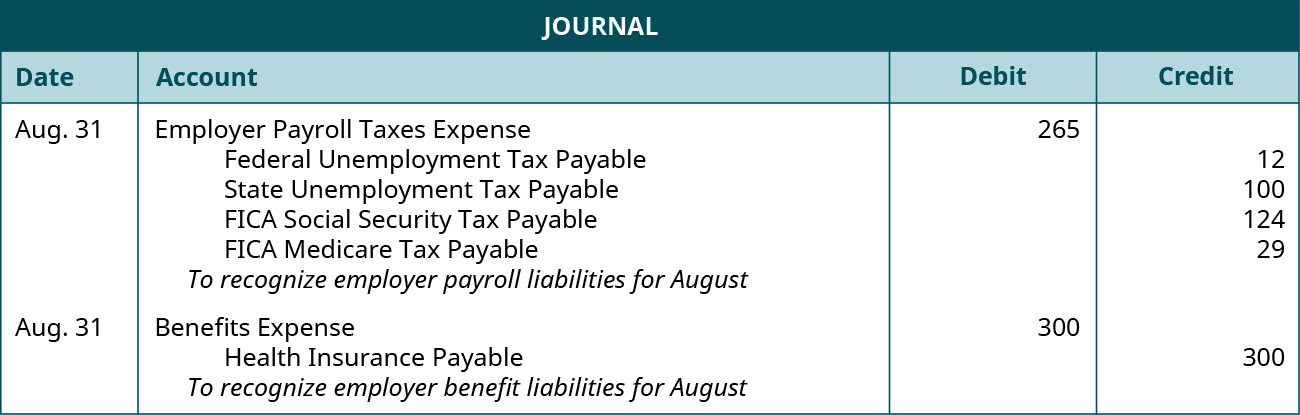

Record Transactions Incurred In Preparing Payroll Principles Of Accounting Volume 1 Financial Accounting

Effective Tax Rate Formula Calculator Excel Template

How To Calculate Income Tax In Excel

Effective Tax Rate Formula Calculator Excel Template

Provision For Income Tax Definition Formula Calculation Examples

Taxable Income Formula Examples How To Calculate Taxable Income

Getting To Know Gilti A Guide For American Expat Entrepreneurs

Taxable Income Formula Calculator Examples With Excel Template

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

Taxable Income Formula Calculator Examples With Excel Template

Taxable Income Formula Examples How To Calculate Taxable Income

How To Calculate Foreigner S Income Tax In China China Admissions